State of the US Emergency Medicine Employer Market - March 2024

Report of Ivy Clinicians' emergency physician, PA, and nurse practitioner staffing group data

Emergency physicians are taught to embrace their emergency departments’ organized chaos. The US emergency medicine staffing market has begun to mirror that chaos.

This year has witnessed bankruptcies and consolidation among large non-physician-owned practices, “green shoot” growth of small physician-owned groups, and steady expansion of larger physician-owned emergency medicine staffing organizations. Meanwhile, hospital administrators at HCA, CHS, McLaren, Maryland, Atrium, and others have debated the wisdom of in-housing their emergency medicine clinicians, thereby owning the chaos.

Below is an analysis of Ivy Clinicians’ data describing the state of the emergency medicine staffing market as of March 2024. Many EM employers have long hidden their ED contracts’ identities behind subsidiaries, shell companies, and “friendly physician” arrangements, making it exceedingly difficult to compile a definitive list of emergency department - emergency clinician staffing group pairings. If you find data inaccuracies in this report, please correct them at https://www.ivyclinicians.io/ or email leon@ivyclinicians.io.

The United States has 5,751 emergency departments - on average, 113 EDs per state. Of those EDs, 1,441 (23.7%) are staffed by non-physician-owned corporations. TeamHealth is the largest staffing firm in emergency medicine, managing the physicians, PAs, and nurse practitioners at 570 emergency departments.

TeamHealth is owned by Blackstone, which describes itself as “the world’s largest alternative asset manager, with $1 trillion of assets under management.” Blackstone acquired TeamHealth for $6.1 billion in 2017. TeamHealth employs approximately 15,000 clinicians across multiple specialties, as well as “administrative support and management across the full continuum of care, from hospital-based practices to post-acute care and ambulatory centers.”

Envision Healthcare, which had been the largest multi-specialty physician staffing company in the United States, went through Chapter 11 bankruptcy in 2023. The restructured company now manages the clinicians at 382 EDs, making it the second-largest emergency medicine practice in the US.

Before Envision’s bankruptcy, it was owned by KKR, the large private equity firm that purchased Envision for $9.9 billion in 2017, saddling the staffing firm with $7 billion in debt. Envision’s lenders - reportedly including Centerbridge Partners, LP, SVPGlobal, Eaton Vance, Blackstone, TPG Angelo Gordon, & Brigade Capital Management, LP - now own Envision Physician Services.

Per reports, HCA Healthcare plans to in-house the HCA-Envision joint venture called Valesco in the summer of 2024. HCA operates 182 hospital-based EDs and over 110 freestanding emergency departments, many currently staffed by Valesco.

Physician-owned practices manage the clinicians at 2,184 (38.0%) US emergency departments, a plurality. The largest such group is US Acute Care Solutions (USACS), which staffs 297 EDs. USACS was formed in 2015 by a combination of several emergency medicine practices and the private equity company Welsh Carson Anderson & Stowe. In 2021, USACS’ physicians bought WCAS’ stake using approximately $1.4 billion in debt raised through the bond market and private credit. USACS clinicians own 98% of the company’s equity.

USACS recently made news by acquiring the Maryland Emergency Medicine Network’s nine emergency department contracts. USACS will have a dominant market position among community EDs in the region surrounding Washington, DC.

34.6% of emergency departments in the US are staffed by their health systems. Permanente Medical Group is the largest such practice, staffing 51 EDs. PMG is a set of “self-governed, physician-led, prepaid, multispecialty medical groups composed of more than 23,000 physicians.” PMG delivers care primarily to patients with Kaiser Foundation Health Plan insurance at Kaiser Permanente facilities.

Perhaps surprisingly, the two emergency medicine practices that staff the most residency training EDs - TeamHealth and Envision - are not owned by health systems or physicians. Of the 419 US residency training sites, TeamHealth manages the attending physicians, PAs and nurse practitioners at 41 EDs (9.8%) and Envision has 30 (7.2%).

Vituity and US Acute Care Solutions staff the most residency training EDs among physician-owned practices, with Vituity managing 18 (4.3%) and USACS staffing 12 EDs (2.9%).

In total, health system-owned practices staff a plurality of US emergency medicine residency sites, with 208 (49.6%) out of the 419 EDs. Physician-owned practices staff 126 (30.1%) of EM residency sites, while non-physician-owned companies manage 80 (19.1%).

Per ACEP, “a freestanding emergency department (FSED) is a licensed facility that is structurally separate and distinct from a hospital and provides emergency care. There are two distinct types of FSEDs: a hospital outpatient department, also referred to as an off-site hospital-based or satellite ED, and independent freestanding emergency centers.”

The number of freestanding EDs has increased over the past few decades, as state certificate of need laws have relaxed and health systems have embraced freestandings’ revenue-generating potential. In 2001, the US had fifty (1.0%) total freestanding EDs. The country now has 770 freestandings, comprising 13.4% of all emergency departments.

Four of the five companies that staff the most freestanding EDs in the US are non-physician-owned practices. Envision staffs 124 (16.1%). However, many of those EDs are staffed through Valesco, Envision’s joint venture with HCA. The health system has indicated that HCA is likely to in-house those practices in the summer of 2024. TeamHealth staffs 100 (13.0%) freestanding EDs.

In total, physician-owned practices manage the emergency physicians, PAs, and nurse practitioners at 395 freestanding EDs (51.3%), while non-physician-owned practices staff 292 (37.9%), health systems staff 82 (10.6%), and the Indian Health Service staffs one. Among physician-owned practices, USACS staffs the most freestanding EDs, with 41 (5.3%).

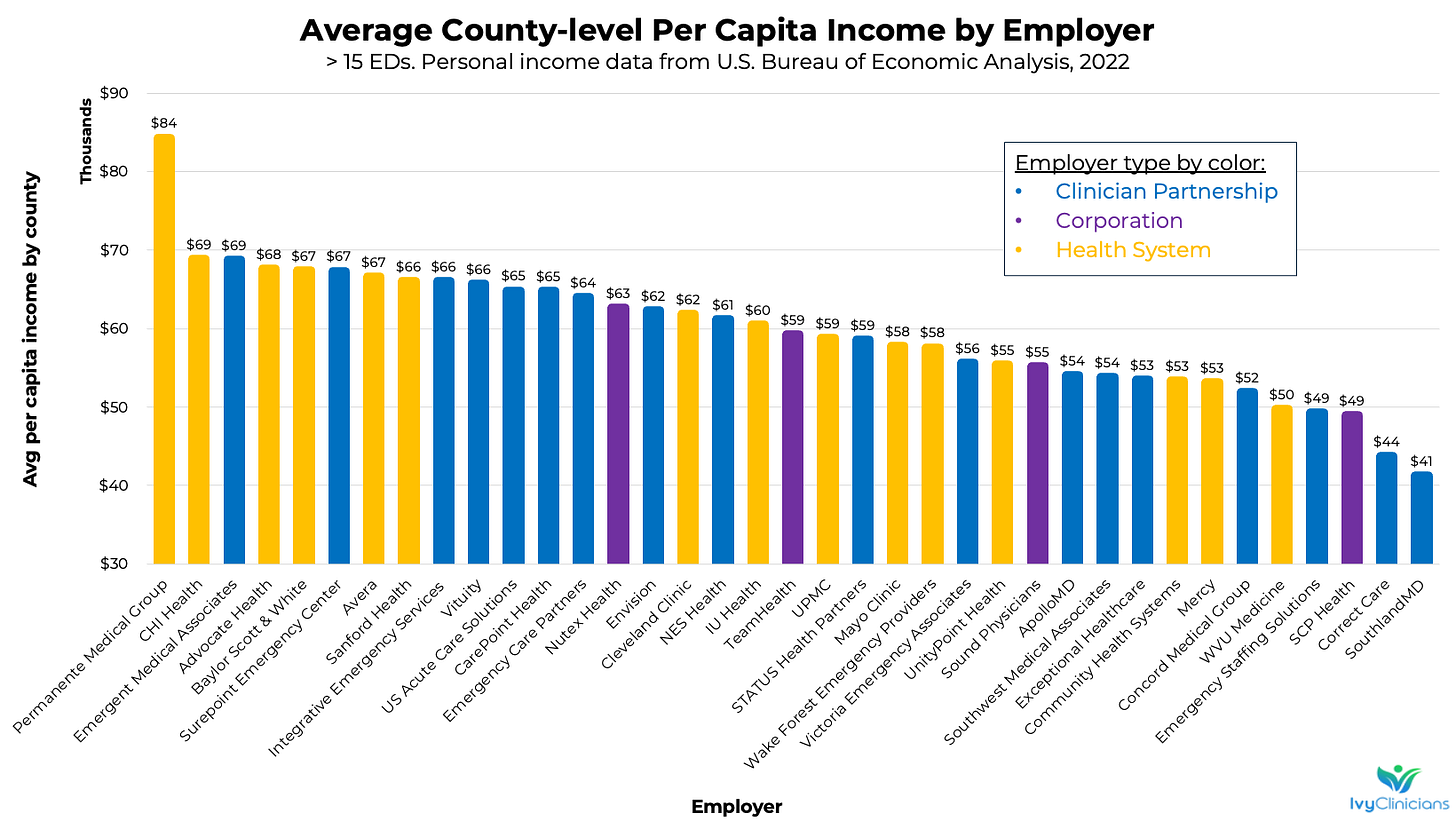

The United States is an economically unequal society, which is reflected in the average income levels of emergency departments’ surrounding communities. Among the forty largest emergency medicine staffing firms, there is a more than two-fold difference in average county-level 2022 per capita personal income between the wealthiest and poorest regions staffed.

For EM employers with more than fifteen emergency departments under management, Permanente Medical Group staffs the EDs in the wealthiest areas. PMG’s average annual county-level per capita income was $84,295, compared with United States’ total average of $65,470. Of EM practices that staff between ten and fifteen emergency departments, Northwell Health has the highest average county-level personal income, at $104,974.

In general, the US’ rural regions and its South have less wealth. This is reflected in the EM employer group data. SouthlandMD staffs EDs mostly in rural Georgia and has the lowest average county-level income, at $41,290. Correct Care staffs mostly small rural EDs and has an average county-level income of $43,724.

SCP Health, the fourth largest emergency medicine group by number of EDs staffed, has EDs in the next-poorest set of regions. SCP employs over 7,500 clinicians in 36 states, across multiple specialties and is owned by Onex.

When considering county-level wealth in this market, it is important to remember that the US healthcare system has many processes to cost-shift between individuals, health systems, and regions.

Emergency physicians and the communities they serve are geographically divergent. Most emergency physicians live in urban areas, while a higher proportion of emergency department patients live in rural regions. Per Christopher Bennett, MD, the author of a large emergency medicine workforce study, “Demand for emergency care in rural areas will remain high while emergency physician shortages in these communities continues to pose significant challenges for health systems and patients.”

An analysis of Medicare data by Gettel et al in the Annals of Emergency Medicine found that “from 2013 to 2019, the number of emergency physicians entering the rural workforce never offset the number leaving from the prior year, suggesting that shortages and inequities in access will persist unless substantial efforts are made to address emergency physician recruitment and retention issues.”

Among emergency medicine employers staffing more than fifteen EDs, the health systems Avera and Sanford Health are in the most rural regions. Both Avera and Sanford Health serve communities in the upper Midwest. Baylor Scott & White, a Texas-based health system, staffs EDs in the most urban set of communities.

Data sources in addition to Ivy Clinicians:

Residency teaching sites were determined through the Society for Academic Emergency Medicine’s Residency Directory.

The 2022 average per capita annual personal income by county was determined through the US Bureau of Economic Analysis.

Rural-Urban Continuum Codes (RUCC) were determined via the US Department of Agriculture Economic Research Service. RUCC 2023 scores range from one to nine, with one being the most urban and nine being the most rural.

Practice type definitions

Health system: a practice in which the emergency clinician group is owned and managed by the hospital, medical school, or health system;

Corporation: a practice majority owned by non-physicians;

Clinician partnership: a practice majority owned by its physicians.

Further information about specific emergency medicine practices and emergency departments can be found on Ivy’s website: https://www.ivyclinicians.io/

Correction note: The initial report incorrectly listed ApolloMD as a non-physician-owned company. This error has been corrected in the document and at IvyClinicians.io. Per Dr. Yogin Patel, CEO of ApolloMD:

"I did want to clarify that as a completely private, independent group in this space for over 40 years, ApolloMD is majority physician-owned. We allow all full-time physicians, PAs, NPs, and company employees to own in the organization, provided they meet our ownership criteria. With that said, physician ownership comprises the majority of our ownership, with roughly 300 physicians taking advantage of that opportunity. In addition, we carry little to no debt, allowing our ownership to carry real value."

Link to prior report (Sept 2023): https://emworkforce.substack.com/p/state-of-the-us-emergency-medicine