State of the US Emergency Medicine Employer Market, Sept. 2023

Analysis based on Ivy Clinicians data.

2023 has been a tumultuous year for the business of emergency medicine (EM) in the United States. Two acute care physician organizations - Envision Healthcare and OPYS Physician Services - declared bankruptcy, and American Physician Partners abruptly ceased operations. This report aims to visualize the current state of US emergency medicine practices.

Ivy Clinicians has matched all 5,705 US emergency departments with their emergency medicine practices. Ivy’s data also connects EM employers with their ownership structure. Emergency physician practice structures generally fall into five categories: clinician partnerships, health systems, private equity, public companies, and governmental (Veterans Health Administration, Military, and Indian Health Service). We have harnessed Ivy’s data to answer the following questions:

What are the largest emergency medicine practices and practice types?

Which practices and practice types staff the most residency teaching sites, level 1 trauma centers, and freestanding emergency departments?

How do the practice settings of EM employers compare in terms of county-level per capita income, uninsurance rates, and rurality?

TeamHealth is the largest provider of emergency medicine services, with 559 EDs under management (9.8%). Founded in 1979 by Dr. Lynn Massengale, TeamHealth is a multispecialty medical group with over 16,000 affiliated clinicians. The private equity firm Blackstone bought TeamHealth in 2017 for $6.1b.

Despite undergoing Chapter 11 bankruptcy restructuring, Envision Physician Services is still the second-largest emergency medicine practice in the US by the number of EDs staffed. Envision manages 440 emergency departments (7.7%). KKR, a large private equity firm best known as the subject of the book Barbarians at the Gates, owned Envision until May 2023. When it declared bankruptcy, Envision Healthcare had $5.6 billion in outstanding debt. Envision is now owned by its creditors, including SVPGlobal and King Street Capital Management.

US Acute Care Solutions is the largest physician-owned emergency medicine practice, staffing 297 EDs (5.2%). In 2021, USACS’ physician owners bought out its private equity partner Welsh, Carson, Anderson, and Stowe, which held a minority stake in USACS.

TeamHealth and USACS were among the top beneficiaries of American Physician Partners’ abrupt collapse. TeamHealth picked up twenty of APP’s ED contracts, while US Acute Care Solutions received eighteen, including APP’s most profitable health system partnership (Houston Methodist).

SCP Health, which considered buying APP, is the fourth-largest emergency medicine staffing company, with 258 EDs (4.5%). SCP, formerly Schumacher Clinical Partners, is owned by Onex, a private equity firm with $51 billion under management.

The Veterans Health Administration is the governmental employer staffing the most emergency departments, with 75 EDs under management. The Defense Health Agency (US military) runs 34 EDs, while the Indian Health Service has 28 emergency departments.

Nutex Health is the only provider of emergency physician services that is a public company. Nutex runs thirty EDs. Nutex’s stock has lost 99% of its value since a peak in April 2022. The company’s market cap is $152 million.

In aggregate, clinician partnerships staff a plurality of US emergency departments, with 2,273 under management (39.8%). Health systems staff the physician practices at 1,944 EDs (34.0%). Private equity-owned groups manage the emergency medicine practice at 1,319 EDs (23.1%).

TeamHealth and Envision staff the largest number of emergency departments that perform significant emergency medicine residency training. TeamHealth staffs 42 academic EDs (10.0%), while Envision manages 34 EM residency teaching sites (8.1%).

A plurality (187 of 419, 44.6%) of the physician practices staffing the 419 EM residency training emergency departments are owned by the EDs’ health systems. Clinician partnerships staff 143 (34.1%), and private equity-owned companies manage the physicians at 84 (20.0%) EM training sites. The US military staffs five academic EDs.

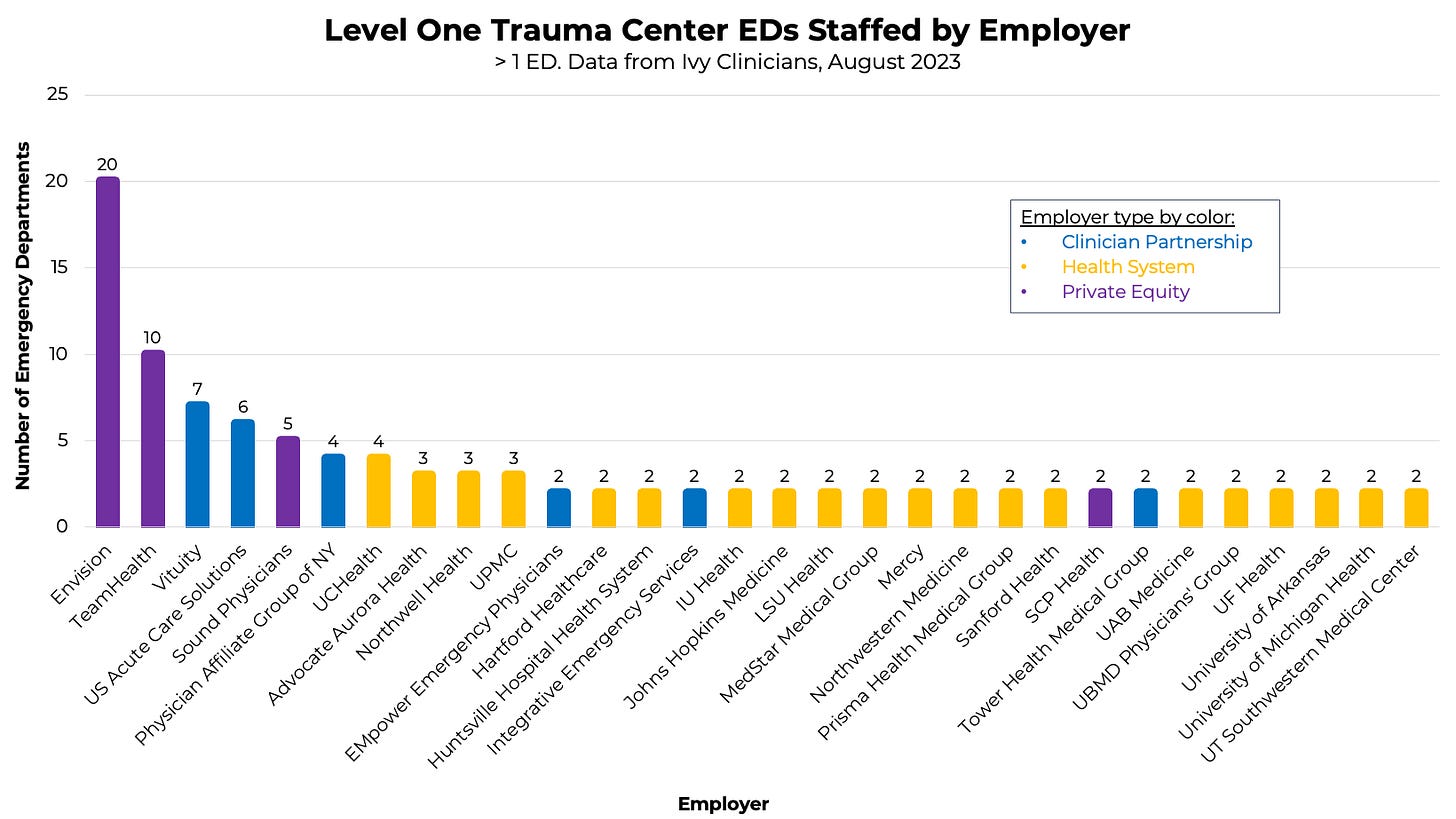

Envision Physician Services staffs the largest number of level 1 trauma centers, with 20 under management (7.8%). TeamHealth manages the EM physicians at ten level 1 trauma centers (3.9%), while Vituity staffs seven (2.7%).

Health systems manage the physician practices at a majority (145 of 256, 56.6%) of level 1 trauma centers. Clinician partnerships staff 28.9% of level 1 trauma center EDs, while private equity-owned practices staff 14.5%.

Hospital systems are opening freestanding EDs at an accelerating pace within state-specific certificate of need constraints. HCA, for example, has expanded its freestanding ED footprint in Florida since the state loosened CON requirements in 2019.

Meanwhile, the number of independent freestanding EDs is decreasing. The No Surprises Act outlawed balance billing of acute care patients starting in 2022, which dealt a blow to the independent freestanding ED business model. Nutex estimated that reimbursement for their services by private insurance decreased by 30% due to the NSA.

Envision staffs 108 freestandings (14.3%), while TeamHealth manages the physicians at 95 freestanding EDs (12.6%).

Per McDermott, Will & Emery, “Freestanding EDs are not recognized as certified Medicare providers and cannot bill Medicare or Medicaid for services. Medicare generally reimburses only EDs that bill under the National Provider Identifier of a Medicare-participating hospital. Therefore, although Freestanding EDs may provide care to Medicare beneficiaries, reimbursement for services provided in such facilities is generally limited to the reimbursement provided to physicians or other professionals for their services. Currently, only four states license independent Freestanding EDs: Colorado, Delaware, Rhode Island, and Texas. All other states that license freestanding emergency departments require the ED to have an affiliation with a hospital.”

Partly due to the large number of independent freestanding EDs in Texas, clinician partnerships still staff a majority (51.7%) of freestandings. Private equity-backed practices manage the physicians at 34.9% of freestanding emergency departments. Nutex, a public company, runs 21 freestanding EDs. The Indian Health Service has a freestanding in Kayenta, AZ.

Based on the US Bureau of Economic Analysis 2021 Personal Income data, we calculated the average county-level per capita income for the counties within which each emergency medicine practice staffs an emergency department.

Of the practices that manage more than eighteen EDs, Permanente Medical Group has the highest average personal income at $83,623 per person. The Permanente Medical Group is interdependent with Kaiser Permanente’s hospital and insurance entities. Per PMG’s website, “The Permanente Medical Groups are self-governed, physician-led, prepaid, multispecialty medical groups composed of 24,000 physicians.”

SouthlandMD, with an average county-level per capita income of $41,479, is at the lower end of the practice location wealth spectrum. SouthlandMD staffs emergency departments in rural Georgia.

Perhaps surprisingly, private equity-owned practices manage emergency medicine practices in poorer counties (in aggregate) than their health system or clinician partnership peers. The average per capita income in counties where private equity-backed practices work is $56,312, compared with $58,960 for health system-run EM groups and $61,673 for clinician partnerships.

Emergency medicine practices in poorer counties relied more than their wealthier neighbors on balance billing and hospital subsidies. With the No Surprises Act ban on balance billing and hospitals’ decreasing willingness to subsidize physician groups, the future financial viability of emergency medicine practices in lower-income communities appears tenuous. The OPYS Physician Services bankruptcy is the latest example of these financial headwinds.

Per the US Department of Health & Human Services, “the national uninsured rate reached an all-time low of 7.7 percent in early 2023.” However, insurance rates vary dramatically by state. States that have chosen not to expand Medicaid since the passage of the Affordable Care Act in 2010 have significantly higher uninsured rates. For example, eighteen percent of people in Texas are uninsured compared to ten percent in neighboring New Mexico.

As a result, emergency medicine practices in non-Medicaid expansion states have much higher average county-level uninsurance rates than their peers. Southwest Medical Associates, which staffs twenty EDs, mostly in Texas, has an average uninsurance rate of 22.1%. On the other end of the spectrum is UPMC - in Pennsylvania, New York, and Maryland - with an average uninsurance rate of 6.4% for their EDs’ counties.

Like the county-level income stats, private equity-backed emergency medicine practices are (in aggregate) located in counties with higher uninsurance rates. Health system-owned EM groups are located in counties with lower uninsurance rates than clinician partnerships or private equity-backed groups.

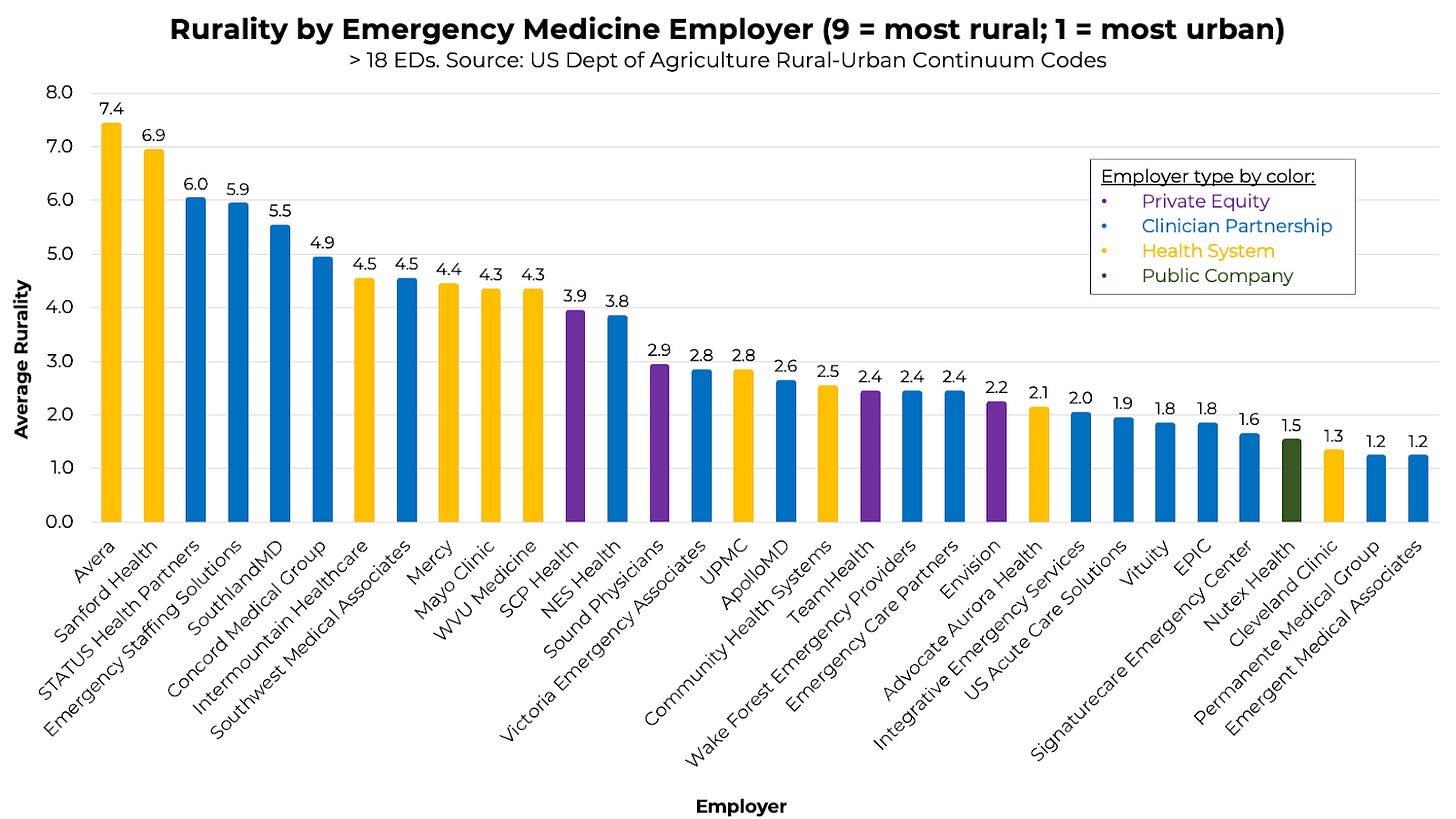

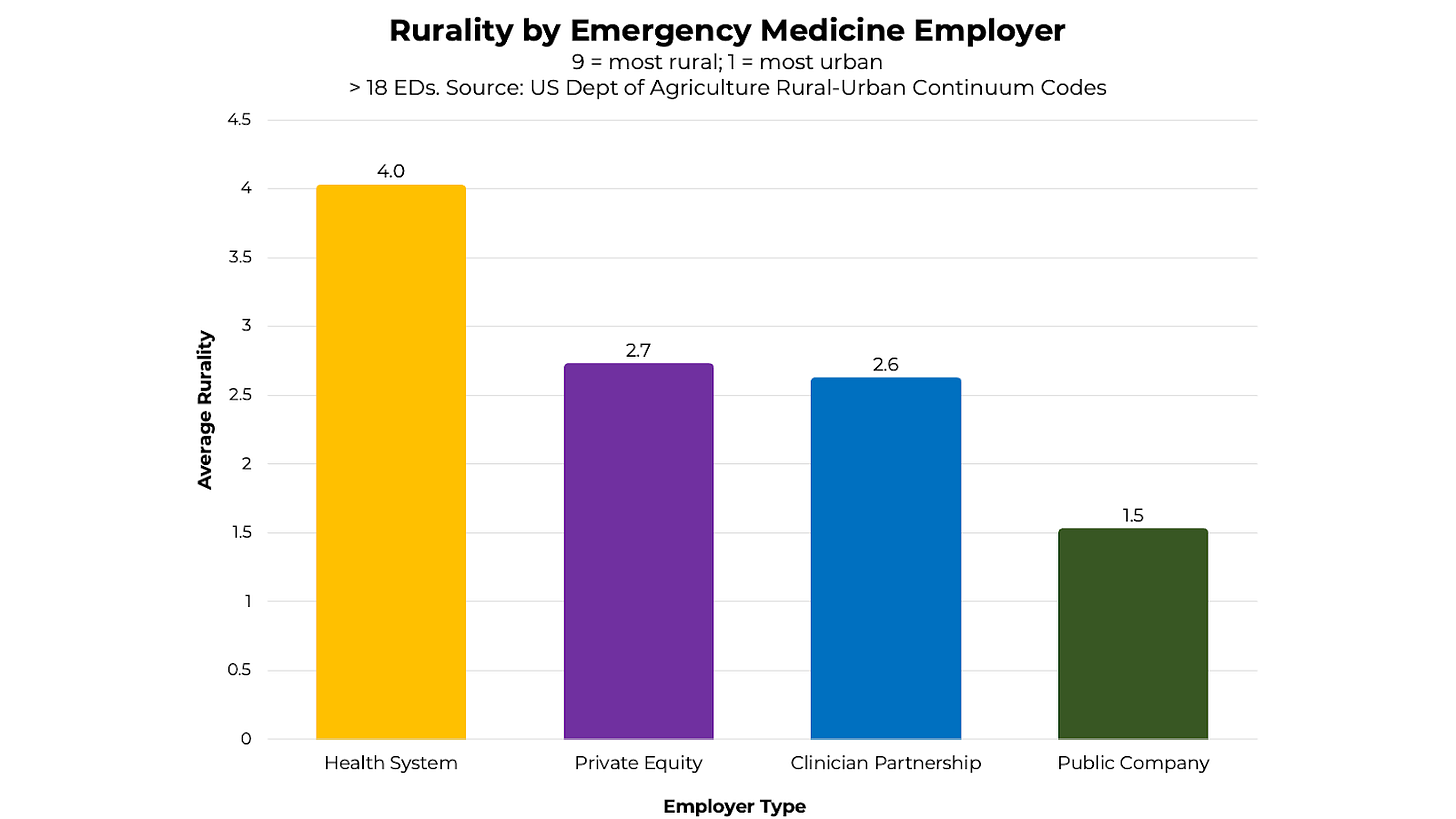

We used the US Department of Agriculture’s Rural-Urban Continuum Codes (RUCC) to evaluate EM practices’ aggregate county-level rurality.

Of practices staffing more than eighteen emergency departments, Avera and Sanford Health are in the most rural counties. Permanente Medical Group and Emergent Medical Associates manage emergency physician practices in the most urban settings.

On average, emergency departments staffed by health system-owned groups are located in more rural counties than private equity-backed practices or clinician partnerships.

Methods

Data was collected by Leon Adelman, MD, MBA, and the Ivy Clinicians team in August 2023.

The following processes were used to pair emergency medicine employers with the EDs they staff:

Obtain a list of EDs from the Centers for Medicare and Medicaid Services (CMS).

Determine the entity billing Medicare for EM professional services at each ED via Medicare’s Care Compare website.

If the Medicare search did not determine the staffing entity, search for an NPI corresponding with EM professional services at the ED’s address.

If the NPI search did not determine the EM staffing entity, search Google.

Self-reported & network effects: some emergency medicine employers provided ED staffing information via Ivy Clinicians’ website, https://ivyclinicians.io/employers.

Other data collection and analysis processes:

Residency teaching sites were determined through the Society for Academic Emergency Medicine’s Residency Directory.

Trauma center designation was determined via the American College of Surgeons list.

The 2021 per capita annual personal income by county was determined through the US Bureau of Economic Analysis (data released November 16, 2022).

County-level uninsurance rates were determined via the US Census Bureau’s Small Area Health Insurance Estimates. The most recent data was from 2020.

Rural-Urban Continuum Codes (RUCC) were determined via the US Department of Agriculture Economic Research Service. RUCC scores range from one to nine, with one being the most urban and nine being the most rural.

Practice type definitions

Health system: a practice in which clinicians are directly managed by the hospital or health system;

Private equity: a practice majority owned by a private equity firm;

Clinician partnership: a practice majority owned by practicing clinicians;

Public company: a company whose ownership is organized via shares of stock that are intended to be freely traded on a stock exchange.

Further information about specific emergency medicine practices and emergency departments can be found on Ivy’s website: https://www.ivyclinicians.io/

This is fantastic data, and obviously took a lot of work. thank you !!

One of the criticisms of the larger groups is that they are "profiting off the backs of EM docs" - are you able to show if compensation is lower overall, or in a geographic market?