American Physician Partners is Not Dead Yet

Also: Practicing EM as we age, ACEP-ENA-AAP statement on peds psych, more physician unions, fewer SNFs, AI in Epic, and insurers' massive scale.

Top of the Week

American Physician Partners (APP), formerly the sixth-largest US emergency medicine practice, abruptly ceased operations on August 1, 2023. Over 1,000 emergency physicians were affected. Most were not paid by APP for shifts worked in June and July. Clinicians were left scrambling to maintain malpractice insurance. In short, APP closed shop in a way that significantly harmed the emergency medicine community.

One month after American Physician Partners’ closure, what have we learned?

APP is not dead yet

American Physician Partners is NOT bankrupt. I received the following note from APP’s crisis communications consulting company: “APP has begun winding down operations, but the Company has not filed for bankruptcy.”

APP has ceased operations, so its expenses are near zero. However, since medical bills can take 2-3 months to be paid after the clinical service, American Physician Partners continues to collect revenue for work done in Q2 2023.

If APP declared bankruptcy using Chapter 7 (liquidation), the company’s finances would be turned over to a bankruptcy trustee. USCourts.gov explains that in Chapter 7, “the bankruptcy trustee gathers and sells the debtor's nonexempt assets and uses the proceeds of such assets to pay holders of claims (creditors) in accordance with the provisions of the Bankruptcy Code.” Revenue would be turned over to the trustee rather than to APP and its owner, Brown Brothers Harriman.

Claims for wages and salaries (including independent contractors) are among the first to get paid out during a liquidation. If APP declared Chapter 7 bankruptcy while continuing to collect significant revenue, their former clinicians would likely receive payment for work done in June and July. Instead, revenues can be turned into corporate dividends and would no longer be accessible when APP finally does declare bankruptcy.

APP will likely not declare Chapter 11 bankruptcy, as Envision did. Per USCourts.gov, Chapter 11 “of the Bankruptcy Code generally provides for reorganization, usually involving a corporation or partnership. A Chapter 11 debtor usually proposes a plan of reorganization to keep its business alive and pay creditors over time.” APP has ceased operations, so it would be expected to pursue a liquidation bankruptcy (Chapter 7).

USACS got APP’s golden goose

Per APP’s 2021 investor slide deck, the Houston Methodist health system contract was by far its most profitable. Houston Methodist generated 32.8% of APP’s margin contribution. US Acute Care Solutions received the contract to staff all eighteen Houston Methodist EDs.

Most APP ED contracts went to big staffing companies

For those hoping that APP’s collapse would revitalize small, locally-owned emergency physician practices, the makeup of new contract holders will be dispiriting.

Community Health Systems, a for-profit hospital chain, has employed the clinicians at twenty EDs formerly staffed by APP. Multiple reports indicate that CHS intends to put the staffing contracts of some or all of these sites up for bid once EM operations have been stabilized.

Private equity-owned groups did well in the post-APP shuffle. TeamHealth, the US’s largest emergency medicine staffing company, picked up twenty ED contracts. SCP Health, which chose against buying APP, staffs sixteen of APP’s prior sites.

Clinician partnerships picked up a third of APP’s former EDs. In addition to USACS’ eighteen Houston Methodist emergency departments, Vituity won eleven contracts. Several smaller groups received one to three APP EDs.

Consequences?

American Physician Partners’ collapse harmed many emergency physicians. Some didn’t get paid for months worth of work and risked losing malpractice insurance. Others, like Congressman Dr. Mark Green, will have their APP equity or debt ownership stakes wiped out.

For APP’s physician leaders, time will tell whether there will be any negative consequences from within the emergency medicine community.

EM Practice

Drs. John Holstein and Jamie Shoemaker discuss emergency medicine’s financial headwinds in EP Monthly.

Dr. Sandra Simons explores the challenges of practicing emergency medicine as we age. “To extend the longevity of our careers, we need to work collectively as a specialty to make sure we accommodate our older colleagues the way we want to be accommodated. Taking care of the older caretakers after they've devoted their lives to taking care of everyone else is the right thing to do. The precedent we set now will ultimately apply to us.”

ACEP, the Emergency Nurses Association, and the American Academy of Pediatrics published a policy statement, “The Management of Children and Youth With Pediatric Mental and Behavioral Health Emergencies.”

Reddit discussion of emergency medicine’s competitiveness in the 2024 residency match.

After the Maui fires, Hawaii’s emergency physician governor faces the toughest emergency response challenge of his career.

House of Medicine

Bloomberg explores the forces behind the growing physician unionization movement in the US. “Doctors at private hospitals are turning to unions to address the loss of autonomy and deterioration of working conditions that they believe are the result of increasing health-care mergers and acquisitions in the wake of post-pandemic economic strains on the industry.”

Epic is deploying AI to alleviate clinician documentation burdens. The EMR company is updating its app marketplace, now called “Showroom,” to enable more third-party vendors. Abridge, Microsoft Nuance, and smaller AI companies are partnering with Epic.

According to Today’s Hospitalist, “total compensation for all hospitalists came in at a mean of $330,371. That’s about $15,000—or 4.6%—higher than we found in last year’s survey.”

Judge: Pennsylvania physician group can't enforce surgeon's noncompete clause.

Hospitals & Health Systems

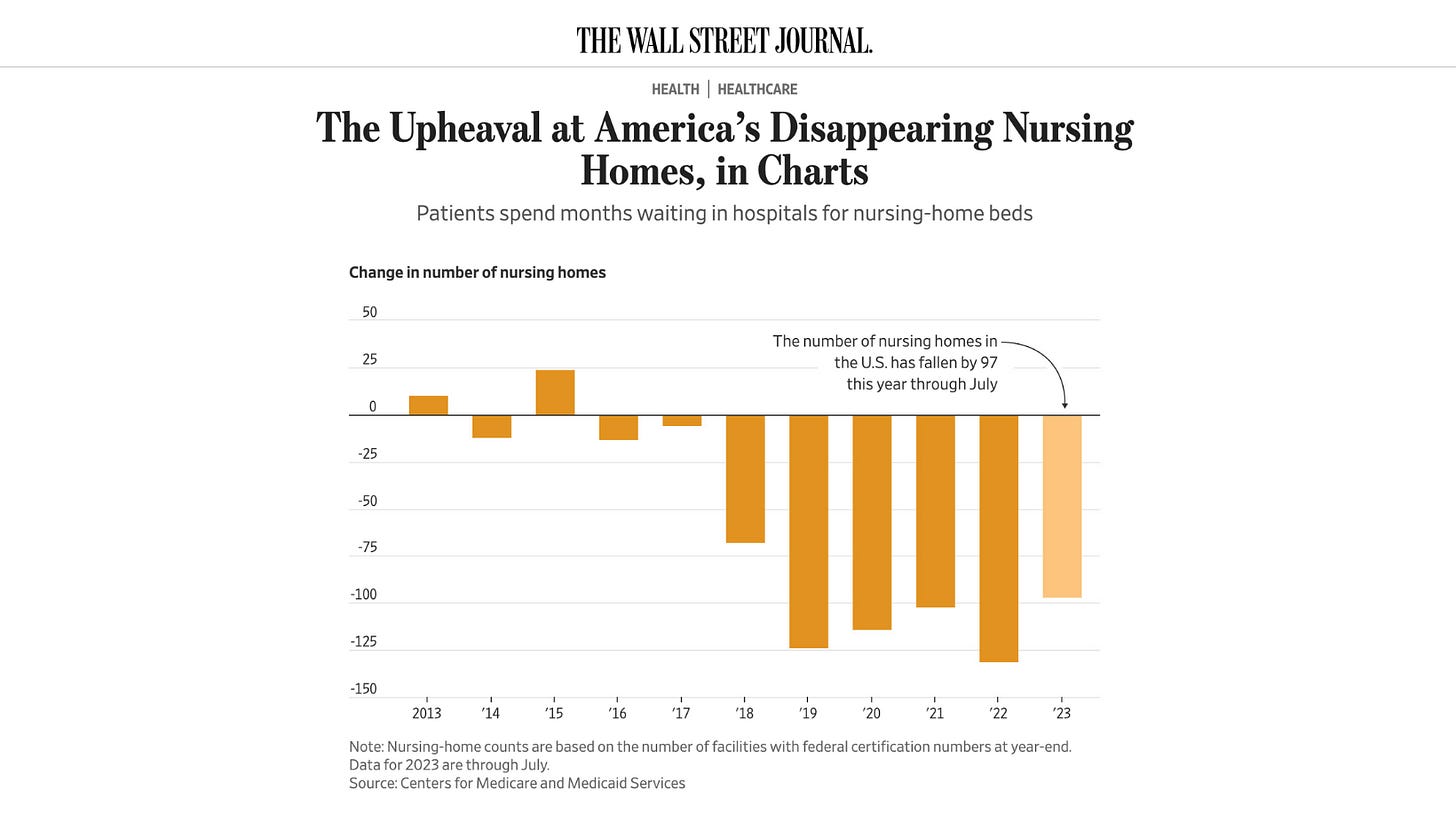

Wall Street Journal and Modern Healthcare report on the US’s shrinking number of skilled nursing facilities. “High labor costs, rising interest rates, and looming federal staffing minimums are prompting more nursing homes and senior living operators to file for bankruptcy.”

Allina Health’s management is having a rough month. Over 550 Allina physicians, PAs, and nurse practitioners filed for unionization, citing “patient safety concerns due to understaffing and inadequate resources; limited input and decision-making power in matters affecting patient care, provider safety, and professional autonomy; the threat of corporate influence on medical decision making; and moral injury caused by pressure to prioritize productivity and profit over patients.” Minnesota authorities are investigating Allina over reports that the nonprofit provider refused to treat some patients who owed medical debts.

Medicare Advantage is cutting payments to rural hospitals.

Oregon Health Sciences University and Legacy Health are planning to merge.

Mayo had a strong Q2 2023, with a 10.4% year-over-year revenue increase.

Nursing & Allied Health

UnitedHealth plans to lay off all nurses at its 150 MedExpress Urgent Care clinics. The company’s representative said, “MedExpress continually assesses and evolves our staffing models to better reflect urgent care industry standards.”

Oregon enacted mandatory nurse-to-patient staffing ratios.

Florida’s nursing staffing crisis is waning. Per the Tampa Bay Times, “Across the state, the vacancy rate for registered nurses has fallen in the past year from 22% to 13%, according to a survey of more than 200 hospitals conducted by the Florida Hospital Association. The turnover rate for nurses has also plummeted from 32% in 2022 to 20%, and hospitals are reporting many nurses have returned to their old jobs.”

The Dispo

From the always insightful Amy Faith Ho, MD MPH (on Twitter-X):

Emergency Medicine Workforce Productions is sponsored by Ivy Clinicians - simplifying the emergency medicine job search through transparency.