State of the Emergency Medicine Employer Market - September 2024

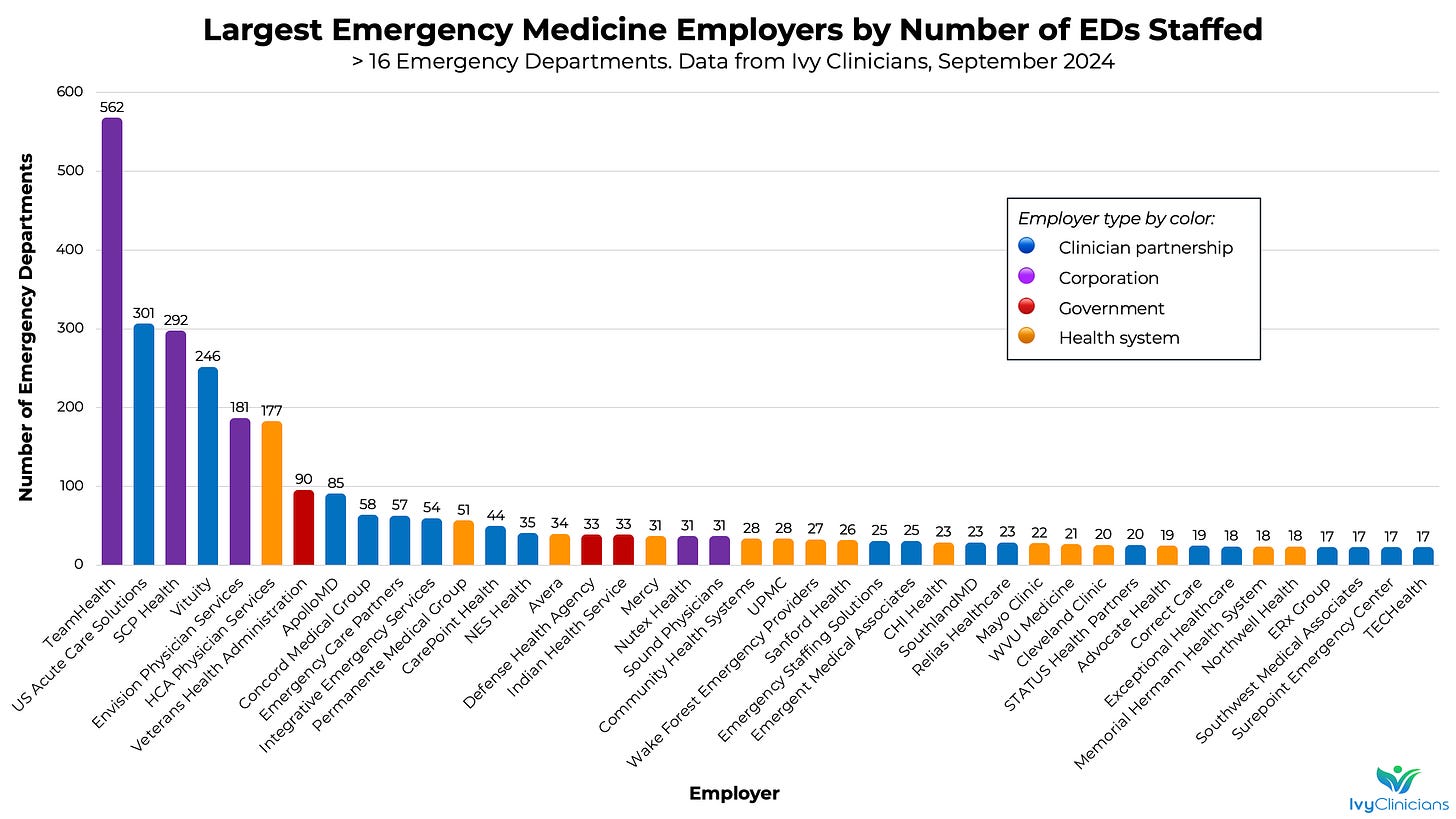

Ivy Clinicians' data show that TeamHealth is the biggest of EM's Bigs, few single-site EM physician partnerships remain, and many residency training EDs are staffed by for-profits.

The bankruptcies of Envision Healthcare and American Physician Partners (APP) - two of the US’ largest emergency medicine practices - shook up the EM job market in 2023. TeamHealth has become the largest employer of emergency physicians, PAs, and nurse practitioners in the US, while for-profit health systems HCA Healthcare and Community Health Systems (CHS) have formed sizable in-housed EM groups.

Below is the latest “State of the Emergency Medicine Employer Market” analysis, based on Ivy Clinicians data.

TeamHealth staffs the emergency clinicians at almost twice as many emergency departments as its main competitors, US Acute Care Solutions and SCP Health. TeamHealth has 562 EDs under management, 9.7% of all 5,814 US emergency departments.

TeamHealth has recently received credit rating upgrades from Fitch, S&P, and Moody’s. According to S&P Global, “TeamHealth has outperformed our expectations for revenue growth and cash flow over the first half of 2024. We now expect modestly positive free operating cash flow (FOCF) in 2024, increasing further to about 2% of debt in 2025 and over 3% in 2026, aided by continued revenue growth and a base interest rate decline.”

However, TeamHealth still has a large amount of debt, with interest rates as high as 14.5%. TeamHealth “concluded 2023 with Fitch-defined EBITDA leverage just over 12.0x (just under 10.0x as reported), well within outlier territory.”

US Acute Care Solutions (USACS) has surpassed Envision to become the US' second-largest emergency medicine staffing company. USACS has taken a financially creative journey to scale. The private equity company Welsh, Carson, Anderson & Stowe co-founded USACS in 2015. USACS’ physicians, financed with $1.6 billion in debt and preferred equity, repurchased over 90% of the staffing firm’s ownership in 2021.

USACS has also earned credit rating upgrades in 2024. Per S&P Global, “We expect revenue growth in the mid-teens percent area for 2024, driven by organic growth in the low-to-mid-single-digit percent area and the full-year impact of acquisitions completed in 2023, as well as increased subsidies from the hospitals.”

However, S&P notes, “We expect USACS' S&P Global Ratings-adjusted leverage will remain high. Including the preferred debt in our calculation of leverage as per our criteria, we estimate the company's S&P Global Ratings-adjusted leverage will remain high at 13x-14x in 2024 and 2025.”

SCP Health, formerly called Schumacher Clinical Partners, has steadily grown its emergency medicine footprint. SCP is owned by Onex, a Canadian private equity firm.

A Moody’s analysis found that SCP “has been more resilient than some of its larger competitors primarily because of greater in-network share of revenues, relatively moderate financial leverage, and a favorable cost structure. While the company remains exposed to payor disputes for its out-of-network business, it has effectively utilized the Federal Independent Dispute Resolution (Federal IDR) provisions to manage this exposure. The company also benefits from interest rate hedges it put in place in 2021, which limits interest rate exposure of more than half of its outstanding debt.”

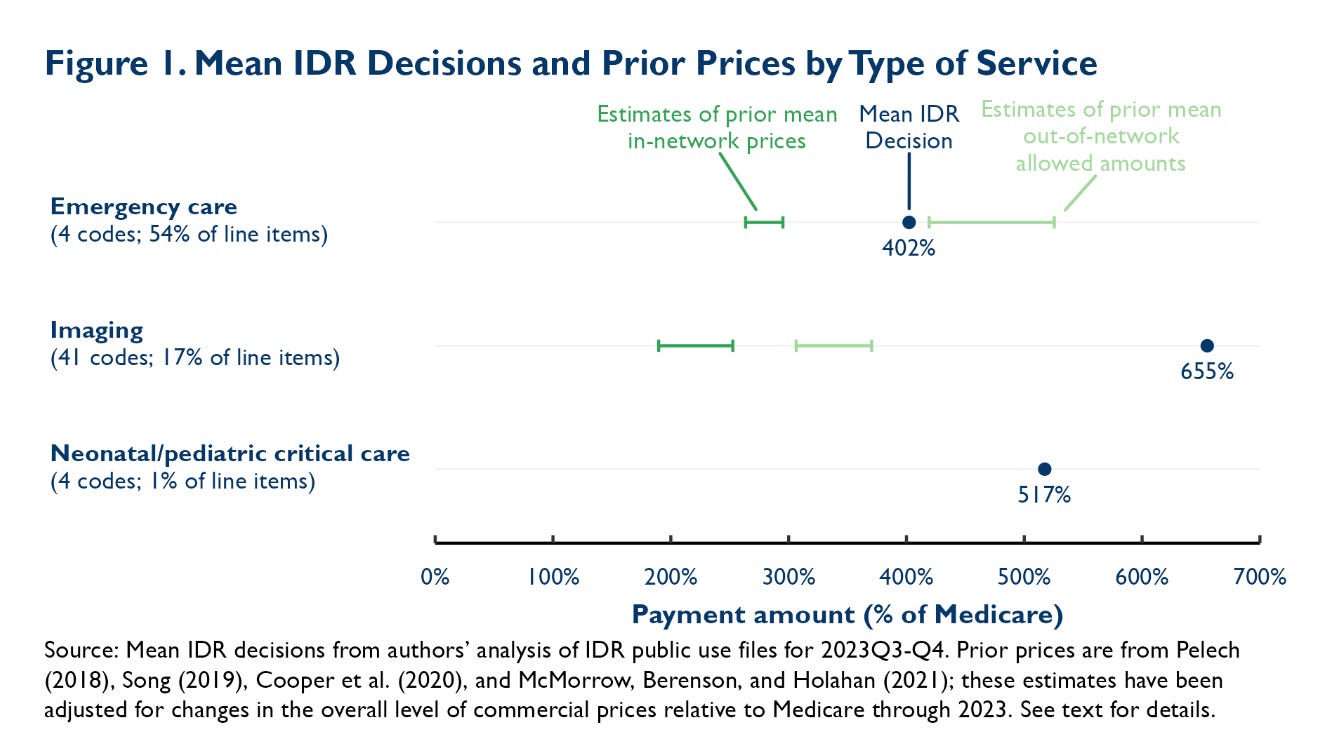

SCP and TeamHealth have been high-volume, successful participants in the No Surprises Act (NSA) arbitration portal. According to Matthew Fiedler and Loren Adler of the Brookings Institution, “For emergency services, the prices emerging from IDR during the second half of 2023 averaged 4.0 times what Medicare would pay; for comparison, adjusted estimates of pre-NSA mean in-network prices for similar services range from 2.6 to 3.0 times Medicare.”

From Day One of medical school, teaching the next set of physician-learners is imbued with utmost importance. The Modern Hippocratic Oath begins, “I swear to fulfill, to the best of my ability and judgment, this covenant: I will respect the hard-won scientific gains of those physicians in whose steps I walk, and gladly share such knowledge as is mine with those who are to follow.”

One can question whether it is optimal for a private equity-owned company to be the entity training the most emergency physicians in the United States. If medical education is so important, might a profit-first corporate structure degrade the education and values imparted to EM’s learners? Blackstone, the “world’s largest alternative asset manager,” owns TeamHealth, which staffs the physicians, PAs, and nurse practitioners at 10.0% of residency-teaching emergency departments (42 of 419).

The next largest - Vituity - staffs 18 residency-training EDs, less than half of TeamHealth’s total. Vituity is owned by its practicing physicians and does not have significant corporate debt.

HCA Physician Services posted the biggest increase in EM residency teaching facilities in 2024. HCA’s in-housed emergency medicine staffing group manages the clinicians at twelve residency EDs.

According to Becker’s Hospital Review on August 28, 2024, “Nashville, Tenn.-based HCA Healthcare has fully acquired Valesco, its joint venture with EmCare, a physician practice management firm affiliated with Envision Healthcare. The acquisition was finalized in June, according to HCA and Envision in statements shared with Becker's. The deal comes after HCA increased its ownership of Valesco from 50% to 90% in April 2023. ‘HCA Healthcare has fully integrated Valesco into HCA Healthcare. We believe this will create more opportunities for us to drive value for our patients, physician partners, and our hospitals while improving the operational performance of Valesco.’”

Envision still staffs seventeen emergency medicine residency-training EDs.

The number of freestanding emergency departments has rapidly increased across the country. Freestanding EDs are usually placed in high-income neighborhoods. The EDs tend to generate meaningful income, though more importantly to their health systems’ bottom lines, they lead to well-insured patient referrals to the parent health system for lucrative procedural care.

According to Healthcare Dive, HCA Healthcare is “increasing its investment in emergency services, noting that emergency room care can drive inpatient admissions and surgeries. Already, HCA holds the most or second-most inpatient market share in about 80% of its markets, [COO Jon] Foster said. Through expanding emergency services, HCA hopes to become the dominant provider for all care in its markets. The health system has added over 100 freestanding emergency departments in the last decade and has another 51 facilities under development.”

TeamHealth staffs 109 (12.7%) of the 858 freestanding emergency departments in the US. HCA Physician Services manages the clinicians at 93 freestandings (10.8%).

The average per-person income in the United States was $65,470 in 2022, the last year for which data are available from the Bureau of Economic Analysis.

County-level average income varies greatly. Crowley County in southeast Colorado had the lowest per capita income in 2022, at $22,240. The average per-person income in the wealthiest county was $406,054 in Teton County, Wyoming, home to Jackson Hole. The difference between the wealthiest and poorest US counties is 18.3x.

Among emergency medicine employers with over fifteen EDs under management, Northwell Health staffs the facilities in the highest average county-level income locations. Northwell is New York’s largest health system. Northwell’s flagship hospitals are North Shore University Hospital and Long Island Jewish Medical Center.

The Permanente Medical Group staffs the next-wealthiest set of counties. Permanente’s relatively well-off patients and the medical practice’s integration with the Kaiser Permanente health insurance company enable PMG to offer its physicians generous compensation and benefits.

The populations served by SouthlandMD and Correct Care are at the other end of the financial spectrum. Most of SouthlandMD’s 23 emergency departments are in rural Georgia. Correct Care staffs nineteen rural EDs in Alabama, Arkansas, Louisiana, and Mississippi.

Data sources in addition to Ivy Clinicians:

Residency teaching emergency department information can be found at EMRA Match.

The 2022 average per capita annual personal income by county data is from the US Bureau of Economic Analysis.

Practice type definitions

Clinician partnership: a practice that is majority-owned by its physicians, PAs, and/or nurse practitioners;

Corporation: a practice that is majority-owned by non-physicians, PAs, or nurse practitioners;

Health system: a practice in which the emergency clinician group is owned and managed by the hospital, health system, or medical school.

Further information about emergency medicine practices and emergency departments can be found on Ivy’s website: https://www.ivyclinicians.io/

Can I get a check to solve all these problems bro I've got 200iq

This letter seems to only focus on the bottom financial line of the various management groups. Is there no interest in who’s taking care of patients well? Who’s got the best throughput times and the least bounce backs? I went into Emergency Medicine to be excellent at taking care of life threatening issues. All these greedy management groups just ruined my career.