The Internet’s Beef with USACS

Also: Envision in technical default, centralizing emergency care, Optum & health systems keep expanding, and Catch Me if You Can.

Top of the Week

Disclosure: I do not currently work for US Acute Care Solutions. In the past, I did work with VEP Healthcare & Emergency Medicine Associates, both of which are now part of USACS.

Last week’s EM Workforce Newsletter received the following comment: “US Acute Care Solutions - is a Contract Management Group backed by private equity (Apollo Global Management).” When Ivy Clinicians posted its 2023 State of the Emergency Medicine Employer Market on Facebook, the first comment was a physician’s objection: “The report lists USACS as a clinician partnership and not PE.”

These comments are in line with frequent critical posts about USACS on EM social media. Examples (password required to access some links): here, here, here, & here.

Why does USACS receive vocal online criticism from emergency physicians? A few thoughts:

Misunderstanding of the USACS - Apollo Global transaction in 2021.

USACS is > 90% owned by its physicians.

In 2015, Welsh, Carson, Anderson & Stowe, a private equity company, funded the formation of US Acute Care Solutions. USACS physicians retained majority ownership in that transaction.

In 2021, USACS bought out WCAS, bringing physician ownership to greater than 90%. Apollo Global Management, a private equity firm, invested “up to $470 million of preferred equity” in the deal. Per Apollo’s statement, “Apollo Funds’ investment facilitates a full recapitalization of the company, which will continue to be majority-controlled by its physician owners, and an exit of previous minority equity owner Welsh, Carson, Anderson & Stowe (“WCAS”). As part of the transaction, two representatives of Apollo will join the USACS Board of Directors.”

Consolidation

US Acute Care Solutions has grown rapidly over the last eight years, largely by acquiring smaller groups. Per Ivy's data, USACS currently staffs 283 EDs. USACS is the third largest EM practice, after TeamHealth and Envision.

Consolidation has downsides, whether the consolidator is owned by a private equity company or by physicians. Highly consolidated employer markets tend to decrease wages (monopsony). In emergency medicine, monopsony effects have been seen in markets like Denver and Charlotte.

On the other hand, consolidation often leads to better reimbursement from insurers. In the No Surprises Act, “market share” is explicitly included as a factor for the arbitrator to include in dispute resolution decisions.

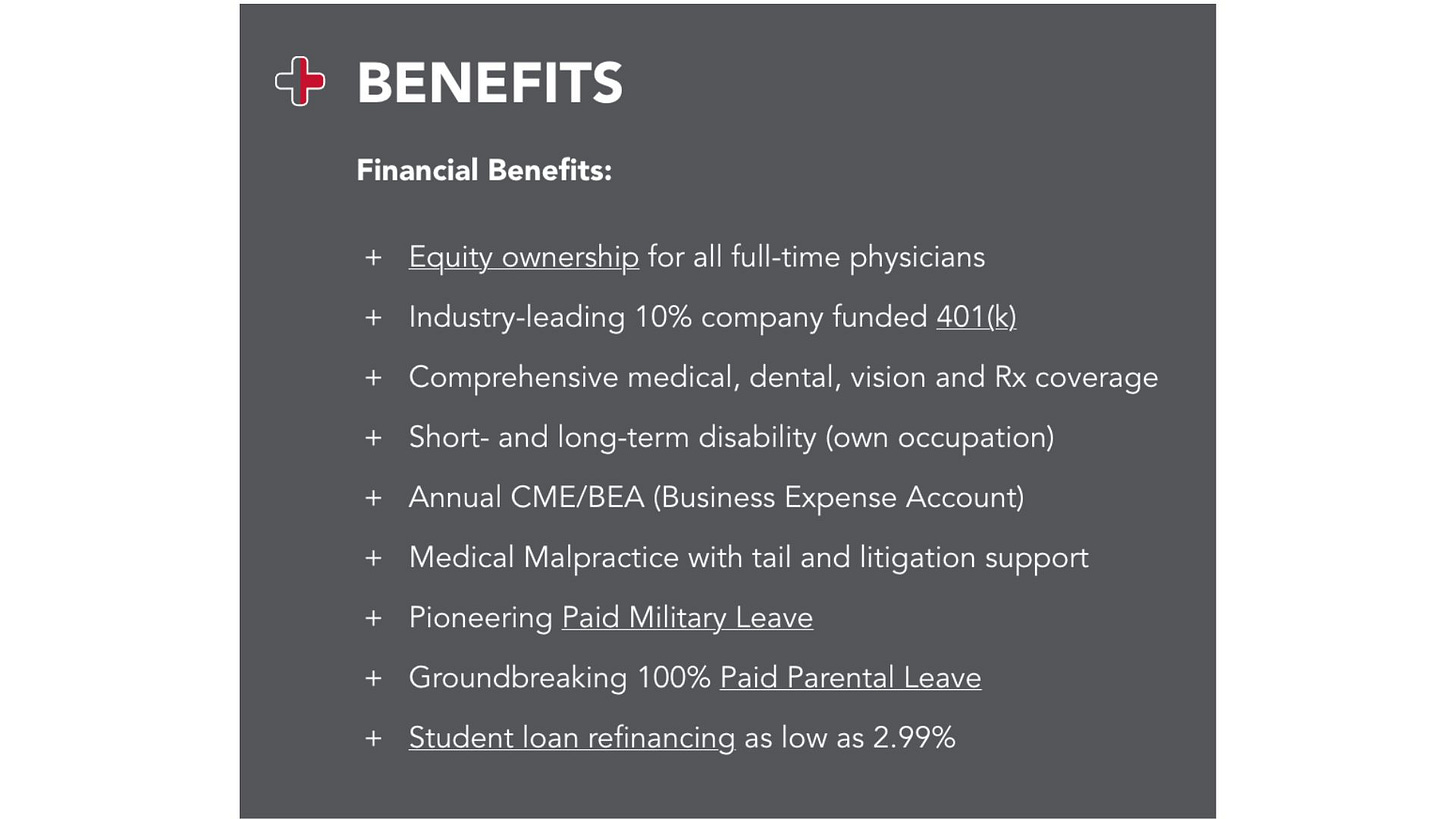

Benefits-heavy compensation packages

Many of the online complaints against US Acute Care Solutions highlight low pay. Part of that perception comes from USACS putting much of their compensation into benefits and productivity incentives rather than into base pay.

A recent USACS emergency physician job post, for example, included the following benefits package:

This piece is not intended to argue for or against consolidation in EM. There are strong arguments for the benefits of smaller, physician-owned practices. Example: JAMA article from this month. However, when discussing these issues, we should be clear about whether the issue is consolidation, private equity ownership, or both. USACS has rapidly consolidated emergency medicine practices while remaining majority-owned (>90%) by physicians.

EM Practice

From the Wall Street Journal: “Envision Healthcare Corp. is in negotiations with some of its creditors after missing a March deadline to report its quarterly financials, according to people familiar with the matter. The Nashville, Tenn.-based physician-staffing company missed the March 31 deadline to report its fourth-quarter financials, triggering a technical default under the company’s loans that it has 10 business days to cure.”

Discussion of whether (and how) to decrease the number of EM residencies. "There are too many [residency programs], hands down," said Leah B. Colucci, MD, president of the American Academy of Emergency Medicine–Resident and Student Association.

Meanwhile, the American Hospital Association is advocating to increase residency spots.

From the Skeptics’ Guide to EM podcast: the down-sides of “centralizing” emergency care, which usually means closing rural hospitals.

ACEP’s current advocacy priorities.

House of Medicine

From JAMA: “Marriage, Children, and Sex-Based Differences in Physician Hours and Income”. Marriage and children were associated with a greater earnings penalty for female physicians primarily because of fewer hours worked.

US News’ (controversial) Top Medical Schools 2023

Optum keeps growing, with the recent purchase of a large physician practice in New York.

Oregon’s mental health system challenges are leaving many kids to board in ERs.

Webinar notice: “Private Equity’s Role in Healthcare” - April 17th at noon Eastern.

Hospitals & Health Systems

Hospitals’ financial pressures due to workforce costs (increased pay to staff) have been easing this year.

Two Wisconsin-based hospital systems - Froedtert & ThedaCare - are merging.

Hospitals really like non-competes that prevent physicians from changing jobs.

Fitch: hospitals faced “worst operating year ever” in 2022.

Nursing & Allied Health

Why the healthcare staffing crisis persists despite returning to pre-pandemic employment levels.

The Dispo

Straight out of “Catch Me if You Can”, a teenager was caught impersonating healthcare professionals in multiple hospitals for weeks. He also scammed his way into buying a $52,000 BMW and renting a fancy apartment. "I feel bad because I kinda fell for it, I was like oh ya, because who does that? Who has the idea to go into the hospital and be like I'm going to be a doctor today," said the ICU nurse.